Account Services

/https://siu.edu/search-results.php

Last Updated: Dec 05, 2025, 07:52 AM

Learn more about each of our services below:

Services

Direct Deposit

Enjoy the Advantages

Convenience - You will not have to wait for mail to come to your house.

Security - Your check will not be lost in the mail, stolen, or misplaced.

Reliability - Your money will be in your account and accessible.

Flexibility - It's easy to switch accounts or change banks. Simply log into SalukiNet and update your bank routing number and account number.

Beginning in May 2012, direct deposit is required for all student refunds.

Direct Deposit

Direct deposit is a safe, secure way to receive your refund. It eliminates waiting for the mail and any hassles with check cashing. By enrolling in the direct deposit program, a student's refund is electronically transferred into an individual's checking or savings account. Direct deposit of refunds gives you the quickest access to your funds.

To enroll in or update direct deposit:

- Go to Salukinet.siu.edu and search for Direct Deposit. Click on the task icon to open and login to the Direct Deposit page. Click here for step-by-step instructions.

OR - students can complete the authorization form and return the form along with a voided check (with your name imprinted on it) to the Bursar's Office.

*Please note that this direct deposit form applies to your Bursar refund only. For additional information on your Student Employment check, please visit the Payroll Department website.

“In order to comply with the US Office of Foreign Assets Control (OFAC) and National Automated Clearing House Association (NACHA) regulations, you must notify the University Bursar’s Office if you receive a payment from the University via direct deposit at a US financial institution and forward the entire amount to a financial institution in a foreign country.”

** If you need to change banks, please update the bank information via SalukiNet. If you would like to cancel your direct deposit authorization, please send us a signed request.

Failure to register for direct deposit may result in a delay in the issuance of your refund.

Payment Options

In Person

Pay in person with cash or check at the Bursar's Office located on the second floor of the Student Services Building.

By Mail

Pay by mail with check or money order. Send payment along with the lower portion of your bill to:

Southern Illinois University Carbondale

ATTN: Office of the Bursar

1263 Lincoln Drive

Carbondale, IL 62901-4704

Online with Credit / Debit Card or using Checking/Savings account

(Additional service fee applies for Credit/Debit card transactions)

Phone with Credit / Debit Card

Call (618) 453-2221 and select option 1, or toll-free at (877)533-0071

*This is for Bursar billed transactions and Perkins Loans only.

*Please note: Payments made by phone will post next business day. No holds will be released until payment is posted.

Installment Payment Plan

International Payment with FLYWIRE

Flywire provides a safe, cost effective, and convenient method of making payments to the University in foreign currencies, including a best rate guarantee on foreign exchange rates. Simply login to Salukinet and make your payment as normal. When you get to the payment method screen, choose the International Payment option at the bottom.

Additional Video Information on Flywire™:

- Click here to make International Payment

- Additional Flywire instructions (Bank Transfer in English)

- For more information: flywire.com/contact

Understanding Your Bill

View your bill on Salukinet now!

Your most recent SIUC Ebill is available on SalukiNet (salukinet.siu.edu).

Students bills can be found under the 'MyFinances' tab on the left hand side in the My Statement channel. For the most recent statement, click the envelope icon in the upper right hand corner of the box. For older statements or to view your account summary or payment history, click the 'Statement and Payment History' link.

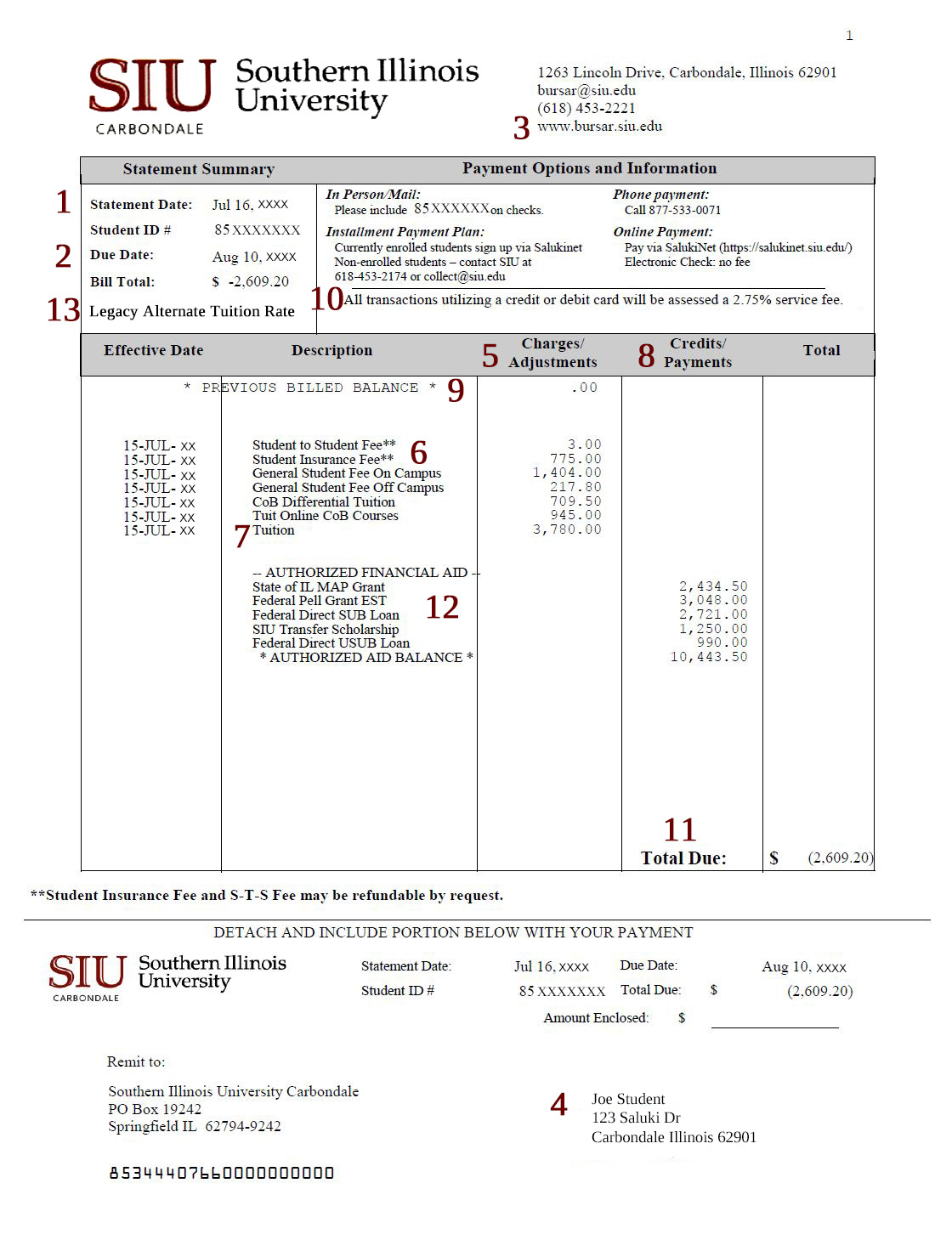

- Statement Date

The statement reflects payments, charges, and credits posted to the account through the workday preceding the statement date. - Payment Due Date

The date by which payment must be received unless you enroll in the payment plan. This may prevent a late payment charge. In addition, your balance needs to be $1500 or less in order to make registration changes. - Bursar Web Site

In addition to on-line payment options, you may access account information, the billing calendar, tuition and fee schedules, tax incentive information, links to other campus departments, and much more. - Billing Address

You are responsible for maintaining a current address and may update your address on SalukiNet. Failure to receive a statement does not relieve you of the responsibility of timely payment of current amounts due. - Charges / Adjustments

Typical charges a student might expect to see on their statement of account (amounts are estimated). - Fees

These are mandatory fees charged as a condition of enrollment. The Student Insurance fee and the Student to Student fee are the only 2 fees which are considered refundable. You may view the individual fees and information regarding those fees by accessing the Tuition/Fees Schedule. - Tuition

Tuition rates are assessed by the Registration office according to the number of credit hours, and when you register for classes. The online tuition calculator can be used to estimate your tuition and fees. - Credits / Payments

Typical credits a first-time student might expect to see on their July statement of account (amounts are estimated). - Previous Billed Balance

This is the student's past due balance from the last billing statement. - Billing Message

Shown after the details of the statement, this message denotes payment and late charge information, as well as other information pertaining to your account. - Total Due

This reflects the total due on the student's bursar account as of the statement date. If the total amount due is not paid in full by the due date, then your account is considered past-due and you will have a Bursar Hold (BH) on your account. No transcripts or diplomas will be released until the past-due balance is paid in full. If the total due is in parenthesis, this indicates a credit balance which could potentially be refunded to you. You will need to check your direct deposit information on SalukiNet to verify your checking or savings account. - Authorized Financial Aid

This is an estimate of your financial aid that is scheduled for disbursement. It is pending financial aid to be disbursed, and has been subtracted from your total due. - Legacy Alternate Tuition Rate

Students receiving a Legacy Tuition Discount will see this notation on their statement. If you have submitted the necessary documentation and do not see this, please follow up with the Registrar. More information can be found here: siu.edu/legacy/

**Note:

If you have questions regarding certain items on your Bursar bill, please contact the following departments:

Contact List

| Department | Information |

|---|---|

| Late Payment Charge/Billing Address | Bursar (618) 453-2221; bursar@siu.edu |

| Financial Aid | Financial Aid Office (618) 453-4334; fao@siu.edu |

| Library Fines | Library (618) 453-2754; mkallal@siu.edu |

| Tuition/Fees | Records & Registration (618) 453-2993; regstrar@siu.edu |

| Telephone Charges | Telephone Services (618) 453-2484; stsr@siu.edu |

| Health Center Charges/Insurance Fee | Student Health Center (618) 453-3311; shcinfo@siu.edu |

| Parking Fines | Parking Division (618) 453-5369; parkingdiv@dps.siu.edu |

| Housing Charges | Housing (618) 453-2301; housing@siu.edu |

| Student ID Card Charges or Debit Dawg | Student Center (618) 536-3351; idcard@siu.edu |

| New Student Matriculation Fee | New Student Programs (618) 453-1000; orientation@siu.edu |

Past due Information

Currently Enrolled at Southern Illinois University

SIU students will incur certain financial obligations. Although they may be eligible for various forms of financial aid, the final responsibility for those financial obligations will be the student's. Failure to meet your financial obligations will have serious consequences: late payment charges will be applied to past due amounts to students with a balance owed to SIUC. If you live in University Housing, please contact them at (618) 453-2301 regarding payment penalties. If you are a current student and have concerns about your account, please contact our Accounts Receivable Department at (618) 453-2221.

Not Currently Enrolled at Southern Illinois University

If you have a balance following your departure from SIU, your account will be referred to our in-house Collections Department. Failure to pay or make satisfactory payment arrangements will result in the account being referred to a collection agency with collection costs added to the student's account which the student is responsible for paying.

If an account must be sent to collection due to nonpayment of the outstanding balance, the university reserves the right to demand payment in full for subsequent terms of enrollment, prior to the beginning of each term to ensure payment. We also will submit a claim for the debt to the State of Illinois under Section 10.05 of the State Comptroller Act. This act authorizes the comptroller to satisfy the debt by withholding any personal warrants (income tax refunds, for example) issued to the student. The student's account will also be assessed a monthly late payment charge of 1.5% on the past-due balance.

Click here for information on how our in-house Collections Department can assist you.

Withdrawal Information

Failure To Attend Class Does Not Cancel Enrollment

Students who register for any semester and decide not to attend for any reason must officially withdraw from the University. Undergraduate students need to contact the Office of Withdraws & Petitions at (618)453-7041 or by e-mail. Graduate students should contact the Graduate Records Office at (618)536-7791 or by e-mail to initiate the withdrawal process. Students should also inquire at this time how their financial aid status, University Housing contract, and Bursar's account may be affected by their withdrawal.

For additional information regarding the University's withdrawal policies, contact:

Teresa Hughes

Registrar's Office-SIUC

Mail Code 4701

Phone: (618)453-5663

Fax: (618)453-2915

Bursar's Forms

- Direct Deposit FormSign up to have your refund deposited to your bank account.

- Address Change FormChange your local, billing, and/or permanent address and fax it directly to us.

- Correction of SSN (Form W-9S)

To correct a student's Social Security Number, complete this form and return it to the Bursar's Office. Proper verification in the form of a social security card will be required to initiate the correction. - Student Insurance Refund Link

Find the Student Health Insurance Refund Form here. - Collection Report

- Bursar Deposit Correction Form

Installment Payment Plan

You must enroll each semester!

SIUC and Nelnet Business Solutions (NBS) are providing an installment payment program for students. Because it is not a loan program, there is no debt incurred and no credit search. There are no interest or finance charges assessed by SIUC or NBS on the unpaid balance while enrolled in the plan.

The nonrefundable enrollment fee to budget payment(s) through NBS is $40.00 for spring and fall and $30.00 for summer.

The nonrefundable enrollment fee and any required down payment for automatic payments from your bank account or credit card will be processed immediately.

You must be registered, have a valid siu.edu email address and assessed tuition for the term you are enrolling in to be eligible for the plan. To set up a SIU email account click here netid.siu.edu and login with your SIU85XXXXXXX number.

For payment plan assistance, please call Nelnet Business Solutions at (888) 470-6014. Customer service representatives are available Monday through Thursday 7:30 a.m. to 7:00 p.m. and Friday 7:30 a.m. to 5:00 p.m. (Central Standard Time).

Commonly Asked Questions About the Installment Payment Plan:

- What is the Nelnet Business Solutions Program?

Nelnet Business Solutions provides a payment program used by institutions across the country. We have been in the tuition management business for more than15 years. For more information about NBS you may review our web site at mycollegepaymentplan.com/siuc

- Do I have to sign up for the Installment Payment Plan?

No, it is optional and you are not required to sign up for the Installment Payment Plan. Many students and their families sign up for the plan in order to make it easier to pay their tuition without having to pay interest to the University.

If you do not sign up for the payment plan, you will be assessed a late payment charge on the unpaid balance. In addition, you will have a registration hold if your balance is greater than $1500 and you are not on the plan. - What are the enrollment deadlines and how many installments can I sign up for.

(Enrollment available on July 15th, Dec 15th, May 15th)FALL 2025 Dates to Enroll Down Payment # of Payments Months July 15 - July 30 None 4 Aug - Nov July 31 - Aug 30 25% 3 Sept - Nov Aug 31 - Sep 30 50% 2 Oct - Nov SPRING 2026 Dates to Enroll Down Payment # of Payments Months Dec 15 - Dec 30 None 4 Jan - Apr Dec 31 - Jan 30 25% 3 Feb - Apr Jan 31 - Feb 28 50% 2 Mar - Apr

*You must be registered for the term in order to enroll in the payment plan for that term.SUMMER 2026 Dates to Enroll Down Payment # of Payments Months May 15 - May 30None2June & JulyMay 31 - June 30 50% 1 July - What indicator will be used to show I am on the plan?

You will see an informational hold on Salukinet (BI = Bursar Installment Payment Plan Indicator). The hold does not affect registration, transcripts, or diplomas. This is just informational and will let our staff know you are on the payment plan. - If payments are made automatically from my bank account or charged to my credit card, does that mean NBS or SIU has direct access to my account?

No. This is a common misconception about automatic payments. No one other than you and your financial institution has access to your account. When you arrange to make an automatic payment through NBS, you authorize your current payment amount to be paid by your bank or Credit Card Company on a specific date. - I am having a problem with my credit/debit card? What should I do?

If using a Credit or Debit card please make sure your daily limit has been increased to cover your payments. Contact your bank if you have problems. - When will monthly payments begin?

Monthly payments will be processed starting on the first payment date you select when you enroll for monthly payments through the QuikPAY Payment Plan enrollment process. Your payments will be processed on the 5th of each month or on the following business day as shown on your payment schedule. If your scheduled payment is not successful, it will be reattempted on the 20th. - What happens if the payment date is on a weekend or holiday?

For eCheck payments, if the payment date falls on a weekend or banking holiday observed by the Federal Reserve, the payment will be attempted on the next business day. Although NBS specifies the date each payment will occur, it is the responsible party's financial institution that determines the time of day the payment is debited to the account (this applies to automatic bank payments only). For credit card payments, the payment will be processed on the payment date regardless of banking holiday. - What happens if a payment is returned?

If a payment is returned, a $30 NBS Missed Payment Fee will be assessed for each returned payment. Your financial institution may also assess a fee. NBS Returned Payment Fees are subject to change in future academic years. After two missed payments, you will be removed from the plan. - May I enroll on campus?

Enrollment in the payment plan is available online only. If you do not have access to a personal computer, you may use the computer terminal in the Bursar’s Office or other computer labs across campus. - What if I don’t have a bank account or a credit card but need to register for the payment plan?

Because a bank account or a credit card is required to use the plan, you should work with one of the many local banks or credit unions to set up an account. - I don’t want to wait to receive my estimated financial aid award package from the University before enrolling in the payment plan. What can I do?

You can sign up for the Installment Payment Plan. As soon as your financial aid is authorized to disburse to your account, your installment payments can be adjusted accordingly. Please refer to question 13. If you have a question about possible financial aid, please contact the Financial Aid Office.- I have registered for classes and enrolled in the payment plan. Now I need to add or drop a class which may change the amount I owe the University. What shall I do?

The student account is checked shortly before the auto-debit each month. If there are changes on your account, your payment plan will be automatically adjusted according to the schedule below.

Auto Debit Table

SemesterPayment DateAutomatic RebalanceFall 2025

8-5-25

7-26-25

Fall 2025

9-5-25

8-26-25

Fall 2025

10-5-25

9-25-25

Fall 2025

11-5-25

10-26-25

Spring 2026

1-5-26

12-26-25

Spring 2026

2-5-26

1-26-26

Spring 2026

3-5-26

2-23-26

Spring 2026

4-5-26

3-26-26

Summer 2026

6-5-26

5-26-26

Summer 2026

7-5-26

6-25-26

If you wish to adjust your payment sooner, you have the option to rebalance your plan by following these steps:

- Go to Salukinet

- Select the “Installment Payment Plan” task or search Installment Plan

- Select the “Payment Plan” option on the left side of the menu

- Click on the “Agreement ID# xxx – View details” link located above the RED action required box

- Click on the “Balance Management” link located on the right side of the “Payment Plan Installments” box

- Select the Rebalance option

- Review your new payment plan details, including installment amounts and due dates!

- I have registered for classes and enrolled in the payment plan. Now I need to add or drop a class which may change the amount I owe the University. What shall I do?

- I have financial aid that will pay all of my tuition and fees for the semester. Do I still have to sign up for the payment plan?

No, however, one benefit to the Installment Payment Plan is that as long as you are in it, you will not be charged interest (late payment charge) on any current charges owed to the University. The amount of your payments can be adjusted based on changes to your balance. If you are not on the payment plan and your balance is greater than $1,500, you will not be able to register or make changes to your schedule. - I enrolled in the Installment Payment Plan when I registered. But now I’ve changed my mind and I want to pay the entire bill before monthly payments begin. Can my enrollment fee be refunded?

No, the enrollment fee is a non-refundable expense to cover Nelnet Business Solutions costs. - I enrolled in the Installment Payment Plan last semester. Do I have to enroll again if I want to use it this semester? Will there be an additional fee?

Yes, enrollment is simple, if you wish you can even use the same banking information that you used last semester. There will be an additional enrollment fee for the new semester. - I lost my credit card and had to cancel it with my credit card company. It was the one that I used when I signed up for the Installment Payment Plan. My credit card company has issued me a new card with a different account number. What should I do?

It is basically a two-step process. It must first be added under payment profiles. Then, it must be assigned to the upcoming payment under PAYMENT PLAN -> VIEW DETAILS -> CHANGE PAYMENT METHOD - I signed up for classes early and have already made a monthly payment. Now I won’t be able to attend school this semester and have to withdraw. It is before the withdrawal deadline. How do I get my money back for payments that I have already made?

You need to officially withdraw from the university immediately as this can have an impact on your refund. If you are an undergraduate student, you should contact Withdrawals & Petitions at withdraw@siu.edu or (618) 453-7041. If you are a graduate student, you should contact Graduate School Registration at 453-2969. This will change your status as a student at SIUC. Your account balance will be adjusted accordingly and your payments through the automatic payment plan will either be reduced or suspended. Once your credit balance is determined it will be refunded to you according to SIUC’s refund policy. - What is a third-party payer? How do I know if I am a ‘third party payer’? What if my parents are paying the bill are they the third party?

A "Third party" is any person or company that you authorize to set up a payment plan on your behalf. Typically, parents, spouses or relatives can be "Authorized Third Parties." In some cases, a company may be a third-party payer. - What happens if I miss a payment on the Installment Payment Plan?

If two consecutive payments are missed, you will be removed from the Installment Payment Plan. You will be charged $30 for each missed payment. Skipped payments may be considered missed payments, and you will be removed from the installment payment plan. - Can I cancel the Installment Payment Plan once I have enrolled?

Please email the Bursar Office at bursar@siu.edu if you need to cancel your plan. Please note, the enrollment fee is non-refundable.

Electronic Billing

Southern Illinois University Carbondale (SIUC) E-bill FAQs

SIU generates electronic bills (E-bills) every month for student accounts that have balances. Students are notified by email when a new E-bill is generated and available via SalukiNet. In an effort to "go green", Southern Illinois University Carbondale does not mail paper bills for currently enrolled students. All students will be able to view their statements on SalukiNet on the 15th of each month, and payment is due on the 10th of the following month. Students can allow parental or third party access to view their account and/or set up alternate email addresses via SalukiNet.

There are many advantages to the new E-bills including:

- Paperless billing system that is cost-effective and efficient

- Statements available online 24/7

- Eliminates mailing delays

- Ability to grant access to authorized users (i.e. parents, spouses, or relatives) to receive bills and/or make payments

Remember: Similar to a bank statement, your E-bill is a snapshot of your account on the day it is generated. Recent activity including charges, payments, or other credits will not show up until the next E-bill is generated.

Commonly Asked Questions Regarding E-bills:

- What are E-bills?

E-bills (electronic bills) are online billing statements. E-bills display the same information as paper bills, such as charges for tuition, fees, and housing, as well as payments and other credits. - How do I access my E-bill?

After the 15th of the month, your E-bill will be available on SalukiNet (salukinet.siu.edu). The billing statements can be found in the "My Finances" tab on the left-hand side under"My Statement". For the most recent statement, click the envelope icon in the upper right-hand corner of the box. For older statements or to view your account summary or payment history, click the "Statement and Payment History" link. For faculty and staff, the billing information can be found under the "My Career" tab in the Bursar's Office channel. - Can I print my E-bill?

Yes. It is available on SalukiNet, and you may view and print a .pdf version of your E-bill which closely resembles the paper bill that you are accustomed to receiving. - I am no longer a student, but still owe a balance to the University. Will I continue to receive a paper bill?

Yes. Non-registered students will still receive a paper bill in the mail, but will also have an electronic bill available on SalukiNet. - Why did I not receive an email notifying me that my bursar bill is now available?

Since this is a mass email, it is possible that your filtering settings may have picked it up as spam. However, you are still responsible for paying your account by the due date. Bills are generated on the 15th of each month, and the payments are due by the 10th of the following month. You may log in at any time to view the most recent bill available on SalukiNet. - Why is the balance on my E-bill different than my current account balance?

Your E-bill is basically a snapshot of your student account at a point in time, similar to any paper bills you may receive. Any current activity that has taken place on your account since the E-bill was created will not be reflected. - Where can I access my bill and Salukinet, if I don't have a computer?

On campus, there are several open computer labs. Try one of these convenient locations:

- Computer Learning Center 1, Faner 1025

- Computer Learning Center 2, Applied Sciences & arts Building 112

- Computer Learning Center 3, Rehn 21

- Computer Learning Center 4, Communications 9

- Morris Library

- Housing - Trueblood basement

- Housing - Lentz basement

- Housing - Evergreen Terrace computer lab

Third Party / Sponsored Billing

Third Party / Sponsored Billing

The Financial Aid Office accepts authorizations from third-party sponsors to invoice the sponsor directly for the tuition and related charges of the sponsored student. A third-party sponsor is an embassy, government agency, or private company that pays all or a portion of a student’s balance directly to the university. The payment must be unconditional; it cannot be contingent on academic performance or employee reimbursement policies. Please note that any portion of the student's bill not covered by the third party is due by the billing deadline in order to avoid any late payment charges. Authorizations must also cover the entire semester.

IMPORTANT NOTE REGARDING HEALTH INSURANCE: If health insurance is provided by your sponsor, it is the responsibility of the sponsored student to have the student insurance fee waived. All policies, procedures, and deadlines are published on the Student Health Services web page at the Health Services Refund Page.

For questions regarding the use of Federal Tuition Assistance, please contact Extended Campus at ectuitionassistance@siu.edu or 618-453-1096.

Authorizations must be on the sponsor’s letterhead and include:

- Sponsor name, billing address, and telephone number

- Student’s name

- Student's Dawg Tag number

- Semesters covered

- Dollar amount and/or definition of fees and charges to be paid

Students should submit their authorizations to the Financial Aid Office before the first day of the semester. Students who fail to submit their financial guarantees on time and are assessed late payment charges will be responsible for paying any late payment charges assessed.

Submit Authorizations to:

SIUC Financial Aid Office

Attn: Private Grants and Scholarships

1263 Lincoln Drive-Mail Code 4702

Carbondale, IL 62901-4702

Scholarship line: 618-453-4628 accountingfa@siu.edu

The extension of credit by the university for an anticipated third-party payment does not relieve a student from any financial responsibilities to the university. If the sponsor’s authorization does not pay the balance in full, the student is responsible for payment of any outstanding balance by the statement due date. If payment is not received from the sponsor, then a hold will be applied to the student's record and the student may be held liable for all charges that may have accrued on the account.